US Private Equity Middle Market 2018 Annual Report

In 2018, the US PE middle market results:

- $427.9 billion total deal value across 2,971 deals (increases of 14.8% and 15.1% YoY, respectively)

- $187.6 billion total exit value across 876 exits (decreases of 10.5% and 14.8% YoY, respectively)

- $110.8 billion capital raised across 131 funds (decreases of 4.4% and 21.1% YoY, respectively)

Overall deal activity in the US MM recorded several milestones in 2018

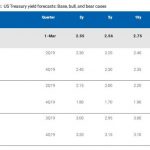

Coming into the year, the MM had not registered a single quarter in which deal value exceeded $100 billion—it happened each quarter in 2018. Consequently, 2018 was also the first year where MM deal value exceeded $400 billion. A sustained market appetite for high-yield bonds and leveraged loans led to an easy financing environment in which dealmakers were able to attain attractive pricing for deal financing. However, attitudes began to change in the fourth quarter as the leveraged loan market—which has swollen in size since the financial crisis—saw downward swings in pricing.

Exit activity in 2018 failed to match the pace of deal activity in the year

Since exit count and value peaked in 2014, total exit value has remained relatively steady, while exit count continues to fall. This is taking place despite the median time to exit plateauing at just over five years since 2015. Additionally, secondary buyouts (SBOs), despite accounting for over half of all exits, accounted for just 31.4% of total exit value.

Fundraising has remained relatively flat over the past five years

We saw several mega-fund ($5 billion+) managers return with MM funds in 2018. Nonetheless, fund sizes within the MM continue to inch up over time, and the average MM buyout fund is now approaching $1 billion. Furthermore, competition for placement within funds across the size spectrum looks to remain healthy as LPs expect to further increase PE allocations.