M&A MARKET UPDATE DECEMBER 2019 SOUTHEAST MONTHLY REVIEW

Notable Trends in December 2019

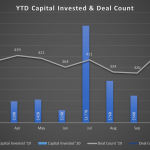

Year to date, US M&A deals in the southeast have continued to slow as the year progresses, and the completed deal count is now down 24.6%. The YTD completed deal count as of the end of December in 2019 is 780 deals versus 1034 deals at the end of December in 2018. Contrasting with the number of transactions declining the average deal size has increased with a total of 29 billion invested in December, most due to the merger between SunTrust and BB&T. For the full year 2019, capital invested was up 142.3% while deal count was down 24.6% meaning that while there were fewer deals, they were much larger in scale.

For the month of December, deal count is down 4.8% compared to that of 2018. Invested capital in December experienced a sharp increase from 2018 to 2019 of 1032%. The invested capital in December is the fourth highest amount in 2019. The median deal size in December 2019 is slightly higher than it was in the same month in 2018 by about 1.5%. The EV/EBITDA multiple for December 2019 of 10.53x is slightly higher than its 2018 multiple of 8.6x but slightly lower than the yearly average of 11.25x.